The major component of the home loan payment will be the principal as well as fascination. The principal is the amount you borrowed, though the desire would be the sum you shell out the lender for borrowing it.

It's usually a smart idea to rate-shop with numerous lenders to ensure you're obtaining the ideal offer accessible.

Doing this could validate your Preliminary hopes about the many benefits of an ARM -- or offer you a reality check about whether or not the opportunity plusses of an ARM definitely outweigh the risks.

Having said that, you can ordinarily obtain individual help by cellphone or even in-human being if you choose a lender with classic branches in your town.

1Personal Loans Charge and Terms Disclosure: Fees for personal loans furnished by lenders over the Credible platform range in between 6.forty% - 35.99% APR with conditions from 12 to eighty four months. Costs offered include things like lender bargains for enrolling in autopay and loyalty applications, where by relevant. True premiums could be distinct from your charges advertised and/or revealed and may be according to the lender’s eligibility criteria, which include things like factors like credit rating, loan sum, loan phrase, credit history usage and historical past, and change depending on loan goal. The bottom costs readily available ordinarily have to have great credit rating, and for some lenders, may be reserved for specific loan reasons and/or shorter loan terms. The origination fee charged because of the lenders on our platform ranges from 0% to 12%. Each individual lender has their very own qualification standards with regard to their autopay and loyalty discount rates (e.

Property finance loan insurance policies: In the event your deposit is a lot less than 20 per cent of the home's obtain value, you'll likely be to the hook for home finance loan insurance, which also is included towards your every month payment.

Debt consolidation and credit card refinancing involve utilizing a new loan to pay back your current harmony. This does not eradicate debt, but replaces a person debt with another. While personal loan rates generally are decrease than bank card interest rates, you may pay back extra in origination service fees and curiosity more than the lifetime of the loan based on other loan terms. Be sure to talk to a economic advisor to determine if refinancing or consolidating is best for your needs.

Classic personal loans tend to acquire reduce fees than credit cards, so they can be an attractive alternative. However you’ll want to take into account your personal funds and what terms you’re likely to qualify for, along with how payments will suit into your month-to-month price range.

1Personal Loans Amount and Phrases Disclosure: Rates for personal loans supplied by lenders about the Credible System range amongst 6.forty% - 35.99% APR with terms from 12 to 84 months. Fees presented include lender discounts for enrolling in autopay and loyalty courses, in which applicable. Actual prices may very well be different from the premiums advertised and/or shown and will be depending on the lender’s eligibility conditions, which contain components for example credit score score, loan sum, loan time period, credit score use and record, and range according to loan intent. The bottom costs available generally demand great credit, and for some lenders, can be reserved for unique loan uses and/or shorter loan conditions. The origination price charged because of the lenders on our System ranges from 0% to twelve%. Each and every lender has their unique qualification criteria with respect to their autopay and loyalty reductions (e.

Payment could issue into how and where merchandise surface on our platform (and in what purchase). But because we usually earn cash when you obtain an provide you with like and acquire, we seek to show you offers we think are a fantastic match for you personally. That’s why we provide attributes like your Acceptance Odds and discounts estimates.

Conventional individual loans are inclined to own decreased charges than credit cards, so they may be an attractive possibility. However, you’ll want to look at your personal finances and what phrases you’re prone to qualify for, as well as how payments will healthy into your monthly price range.

As an example, they usually provide lessen fascination rates than credit cards, making it simpler to lessen the overall curiosity you pay back here if you employ a personal loan to consolidate your debt.

Afterpay is usually a sensible choice if you want to generate a invest in-now, spend-later buy without having interest. You’ll be expected to produce 4 payments more than six weeks to pay off your invest in.

At that point, Microsoft Advertising will make use of your whole IP deal with and user-agent string to make sure that it might effectively procedure the ad click on and charge the advertiser.

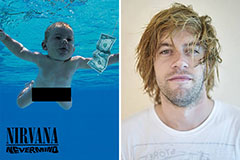

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!